A version of this article was published in the January 2018 issue of California CPA Magazine.

California is often considered a land of opportunity. Today, many companies that operate within the state are finding themselves in the enviable position of needing to expand in headcount and facilities to meet market demands. By using sophisticated tax strategies and making timely state and federal tax incentive claims, these companies can see significant tax savings—and then reinvest those funds back into their business.

California is often considered a land of opportunity. Today, many companies that operate within the state are finding themselves in the enviable position of needing to expand in headcount and facilities to meet market demands. By using sophisticated tax strategies and making timely state and federal tax incentive claims, these companies can see significant tax savings—and then reinvest those funds back into their business.

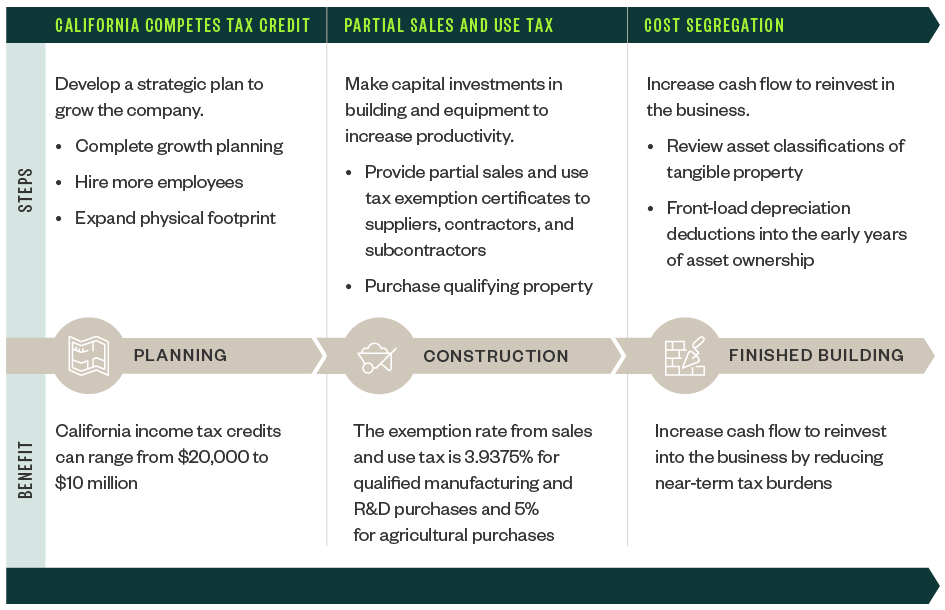

Throughout each stage of the expansion process, from concept to construction to a finished building, there are three specific tax strategies California-based companies can employ to reduce their tax burden. As each phase of the expansion project is completed—and each tax strategy is used—the tax-savings potential grows exponentially.

Expansion Tax-Strategy Timeline

California Competes Tax Credit

In the California Competes Tax Credit (CCTC) program’s 2017–2018 fiscal year, the California Governor’s Office of Business and Economic Development (GO-Biz) is authorized to negotiate more than $230 million in California income tax credits over three application periods. With the first application period valued at $75 million when completed, an additional $100 million is set to become available when the second application period opens January 2, 2018, and $55 million for the final application period beginning March 5, 2018.

While the CCTC is slated to expire after the March application period, legislation has been proposed to extend the program.

Who Qualifies

GO-Biz’s goal is to incentivize businesses to grow new full-time jobs and capital investments in California. For that reason, the CCTC is available to businesses located both in and outside of California, regardless of size or industry.

Past CCTC awardees have included sole proprietorships, Fortune 500 enterprises, tech start-ups, and even beehive cultivators. However, two common business activities have dominated the list of awardees since the program began in 2014: manufacturing and R&D.

How It Works

CCTC awards are negotiated and granted on a competitive basis. Essentially, businesses that apply for the CCTC compete against one another based on the amount of California full-time jobs they’re projecting to create as well as how much they intend to spend in California capital investments over the next five years.

While CCTC awards are regularly granted to businesses growing several hundred full-time jobs and spending well into the tens of millions in capital investments, meaningful awards are also commonly granted to businesses growing far fewer jobs and spending far less on investments over that same five-year period. This is especially true for those performing manufacturing or R&D activities.

With two application periods left in January and March of 2018, a company’s application timing is critical if it hopes to receive a CCTC award. The current CCTC law will sunset on June 30, 2018, the end of the 2017–2018 fiscal year.

Example

Let’s say a manufacturer of optical devices is growing rapidly. The company set a high standard for its competition and attracted a devoted customer base; however, its growth is putting pressure on existing resources.

The company’s plan to expand its California headquarters and hire additional staff makes it a prime candidate for the CCTC, so it develops a compelling story for the CCTC selection committee and is successful in applying for and negotiating a CCTC award of $750,000 that it can now reinvest into its business.

Partial Sales and Use Tax Exemptions

The California Department of Tax and Fee Administration (CDTFA) issued two regulations that allow businesses to claim a partial sales and use tax exemption. Each regulation has the potential to provide significant tax savings for companies based in California. The regulations apply to:

- Costs associated with manufacturing and R&D

- Purchases of agricultural equipment

Manufacturing and R&D—Regulation 1525.4

The CDTFA’s Regulation 1525.4 allows a 3.9375% partial sales and use tax exemption for qualified tangible personal property used in manufacturing and R&D activities as defined in the 2012 North American Industry Classification System (NAICS) codes 3111-3399, 541711, and 541712. After January 1, 2018, electric power generators whose activities fall under 2012 NAICS codes 22111-221118 and 221122 will also qualify for the partial exemption.

Agriculture—Regulation 1533.1

California also allows a 5.25% exemption from sales and use tax on purchases of farm machinery and equipment used in qualified agricultural activities described in the 1987 Standard Industrial Classification (SIC) Manual in major groups 01, 02, and 07.

Who Qualifies

A company that has activities in California that meets the definition of manufacturing, R&D, or electrical power generation can qualify for the partial sales and use tax exemption for purchases of qualified tangible personal property when that property is used in those qualified activities; even if those aren’t its main activities. Provided it’s conducting a qualified activity in some capacity, a company can qualify for the partial exemption as a legal entity or as an establishment of a legal entity, such as being accounted for in a separate cost center, division, or physical location.

The agriculturally-focused Regulation 1533.1, on the other hand, is limited to ranchers, farmers, and most agricultural businesses except for timber-production companies. Persons who assist a qualified rancher, farmer, or grower in the production and harvesting of agricultural products may also qualify for the exemption.

How It Works

The tax savings for companies that claim a partial sales and use tax exemption on qualified tangible personal property is approximately $39,000 for every $1 million in qualified spending and about $52,000 for qualified agricultural equipment purchases.

Qualified tangible personal property means any machinery and equipment used for manufacturing or R&D that has a useful life of at least one year, including component parts and contrivances. After January 1, 2018, the definition also includes any machinery and equipment used for electric power generation. This could include the following:

- Equipment and devices used or required to operate, control, regulate, or maintain the machinery, including computers and computer software

- Equipment or devices used in pollution control

- Special-purpose buildings and foundations with at least 50% of their floor space dedicated to manufacturing, processing, fabricating, refining, or research

Items don’t need to be capitalized in order to qualify. The partial exemption may also extend to items used in nonqualified activities, provided qualified activities comprise 50% or more of the equipment’s use on the property. Any company that has qualifying activities in California can claim the exemption until June 30, 2030, a sunset date that was extended from June 30, 2022. The agricultural exemption ends July 1, 2022. Businesses that have overpaid tax from the July 1, 2014, inception of the exemption may qualify for refunds. However, the California statute of limitations is three years, so tax credits may expire if a protective claim for refund isn’t filed.

Example

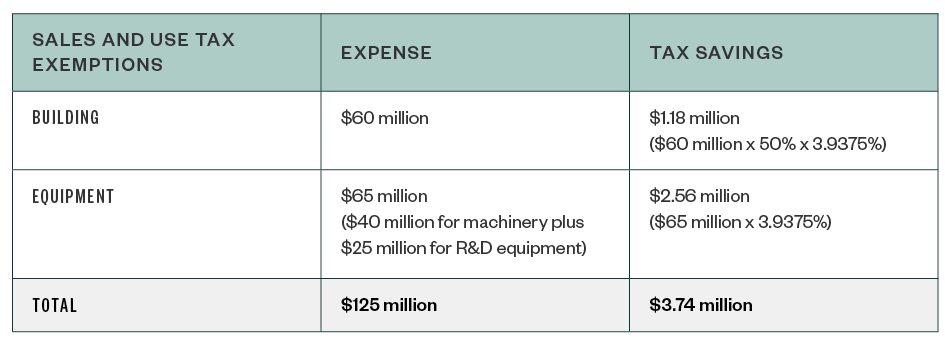

Assume the same manufacturer of optical devices from the previous example is planning to engage a contractor to build a manufacturing facility in California. The new facility will house the company’s manufacturing and R&D divisions. The construction of the new facility is estimated to cost $60 million, plus an additional $40 million for the machinery. Another $25 million is budgeted for R&D equipment.

The building contractor can obtain a 3.9375% tax savings for purchases of materials, and this savings can be passed to the manufacturer in the form of a reduced contract price. In a typical construction contract, materials can make up 50% of a contract price, so in this particular scenario, the company could see the following tax savings on the project.

Approximate Tax Savings

Cost Segregation

When a California business purchases, remodels, or constructs a new building, it may defer federal and state taxes by using a tax strategy called cost segregation. This strategy, which separates a portion of building components into their proper asset classifications with shorter recovery periods, allows businesses to front-load their depreciation deductions into the early years of asset ownership. In doing so, a company is able to increase cash flow in the near term by lowering their tax burden.

Who Qualifies

Companies operating anywhere in the United States can benefit from cost segregation, provided they own or lease real estate. California's high state tax rates make cost segregation especially useful for companies with California operations looking to reduce their tax burden.

How It Works

Cost segregation may be applied to almost any facility, including manufacturing operations, apartments, offices, and even wineries. Engineering and cost-estimating techniques are used by cost segregation professionals to identify building components that can be considered nonstructural and part of the machinery or closely related to the business activity. These identified assets may qualify for shorter tax lives of five, seven, and 15 years, rather than the standard 39 years for commercial properties and 27.5 years for residential rental properties. Cost segregation studies will analyze and provide support for the assets’ tax positions.

Example

In our example of the $60 million optical device manufacturing facility, the full amount of the facility is usually depreciated over 39 years. Without taking a closer look at the construction costs through a cost segregation study, only $6,987,000 of depreciation expense would be recognized over the first five years using the standard straight-line method.

By conducting a cost segregation study, however, the cost segregation professionals were able to identify a significant portion of the electrical and plumbing systems as relating to manufacturing and R&D functions. The study also found extra costs were incurred during construction to create thicker concrete foundations that could support heavy manufacturing equipment. The study reallocated 10% of the construction cost to 15-year site improvements and 20% to five- and seven-year tangible personal property.

New site improvements and tangible personal property can also qualify for federal bonus depreciation in the first year and use accelerated MACRS depreciation methods instead of the straight-line method. Identifying a combined 30% of construction costs to their proper shorter recovery periods yields a depreciation expense of $19,682,000 over five years, an increase of $12,695,000 from the standard amount. Assuming a combined tax rate of 40.75% and adjusting for California’s depreciation rules, the cost segregation study provides a potential tax deferral of approximately $5,000,000 in combined federal and California state income taxes over the first five years.

Next Steps

The California Competes Tax Credit, partial sales and use tax exemption, and cost segregation studies can all help reduce the financial burden of expansion. To make the most of these tax-saving opportunities, however, it’s prudent for business owners to work with their tax professional to align their company’s tax strategy early in the organization’s growth process so important deadlines aren’t missed.

We’re Here to Help

If you'd like to learn more about how your business could potentially benefit from the tax-planning strategies discussed in this article or other possible tax-savings opportunities, contact your Moss Adams professional.